High value items will be covered under a typical home insurance policy, but not past a certain dollar amount, unless your policy includes special provisions.

Different insurance companies may have different limits, but generally it breaks down something like this:

- $1,500 per item

- $3,000 for combined value

- If the value of any item exceeds the limit, it will not be covered past that limitYour home insurance policy’s limits may be a little higher than this, but this example gives you the general idea. This applies to jewelry, firearms, coin collections, silverware or anything of particularly high value.

In order to get these items covered, you’ll need a scheduled personal property endorsement.

Scheduled items may be covered for their full value, rather than up to the standard limits of your policy, but these items are subject to the same exclusions as any other items in your home, which will probably mean the following:

- These items will not be covered for wear and tear. So, if you cover an expensive fur or leather jacket, don’t expect to file a claim for it when the sleeves start to wear down.

- Infestations will typically not be covered. A collection of antique books won’t be covered should mice chew on them, for instance.

- War and nuclear hazard won’t be covered in any event. This probably isn’t a major concern.If you want to schedule items for coverage, you will want to make sure to keep a detailed inventory. Here’s how you can do that:

- Keep the receipts

- Make a list

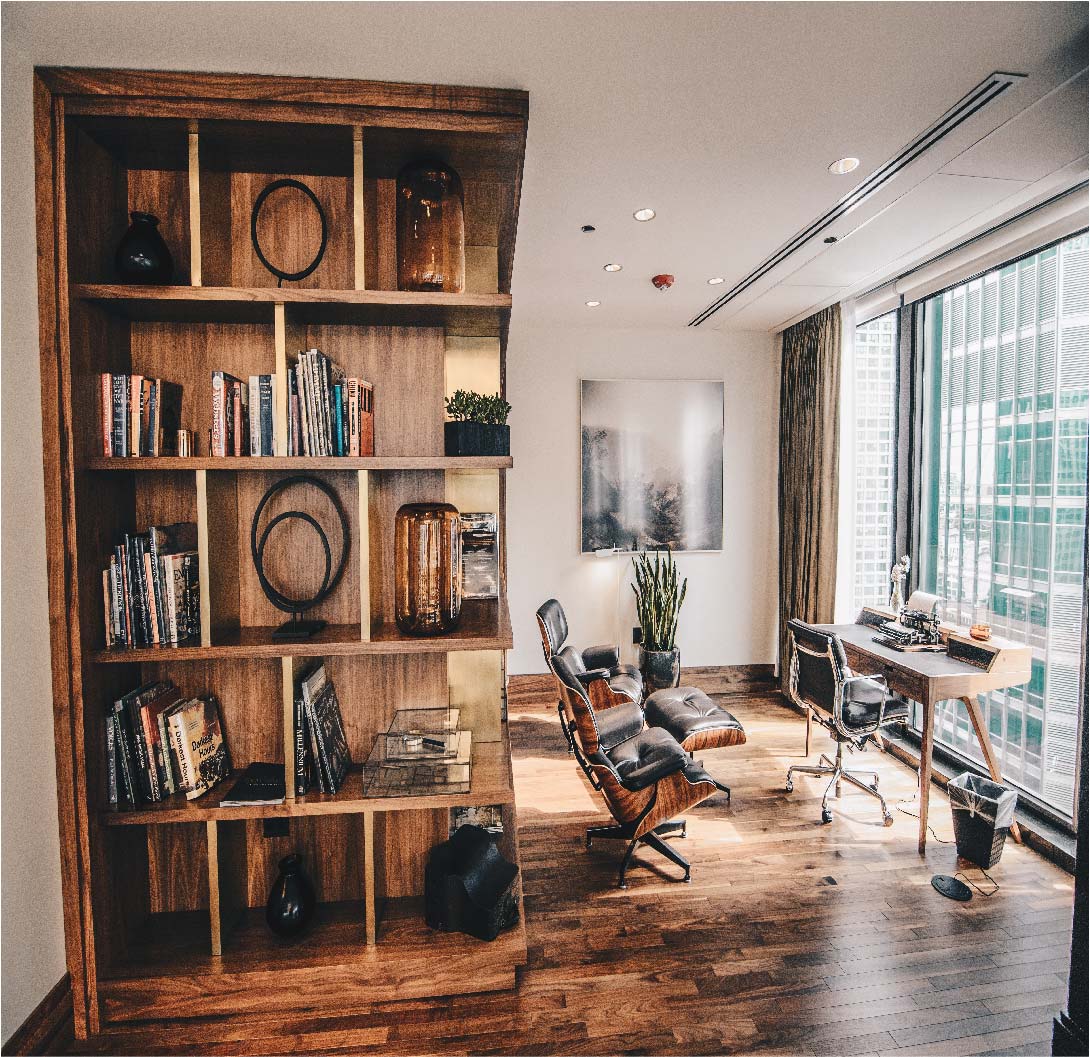

- Take photos

- Take video

- Make sure that you keep your insurer updated with a fresh inventory

There are items that are potentially best covered through specialty insurance rather than through your home policy, but by and large, you can cover most high-value items through the same plan that you use to cover your TV, stereo and other common possessions.

So, short answer: Your home insurance policy doesn’t automatically cover high-value items. You can buy extra protection for them, but don’t expect them to be included in your standard inventory.